maricopa county tax lien map

Welcome to the world of Maricopa County Arizonas Tax Liens. The median property tax in South Carolina is 68900 per year05 of a propertys assesed fair market value as property tax per year.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

It also has some of the lowest property taxes.

. Auction properties are updated daily on Parcel Fair to remove redeemed properties. View Jefferson-Bessemer Tax Auction Map View Jefferson-Birmingham Tax Auction Map. We would like to show you a description here but the site wont allow us.

South Carolina has one of the lowest median property tax rates in the United States with only five states collecting a lower median property tax than South Carolina. Our tax experts are hear to help and can answer your questions and guide you to tax minimization. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars.

The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Across the US Mohave County is the fifth-largest county in terms of area. Appeal Deadline for Maricopa and Pima is April 24th.

Visitors can enter from either Country Club Dr. The median annual tax payment in Mohave County is just 952 which is about half the national average and less than the state average. Coconino Maricopa Mohave Navajo Pima Pinal and Yavapai 2022 tax auctions.

Reference the map below to navigate upcoming tax deadlines and important dates. South Carolinas median income is 52001 per year so the median yearly property. 2022 County Tax Lien Auctions.

Kane County collects on average 209 of a propertys assessed fair market value as property tax. Notices issued in late December. Pursuant to Arizona Revised Statutes Title 42 Chapter 18 Article 3 Sections 42-18101 through 42-18126.

Free Arizona Property Records Search. The average effective property tax rate in the county is 063. Find Arizona residential property records including property owners sales transfer history deeds titles.

Kane County has one of the highest median property taxes in the United States and is ranked 32nd of the 3143 counties in order of median property taxes.

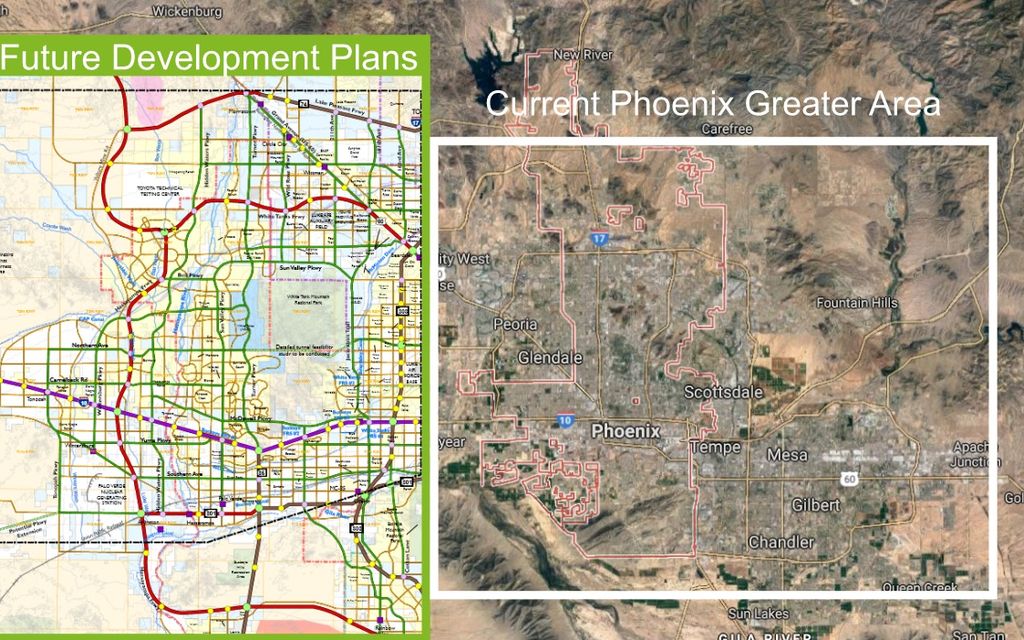

Land Brokers Phoenix Arizona Land For Sale

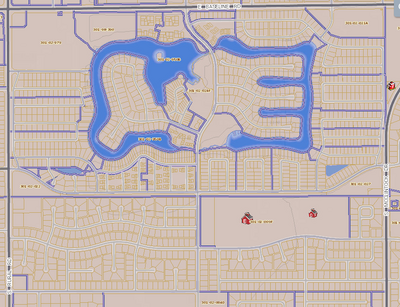

2017 Maricopa County Parcel Data Asu Library

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

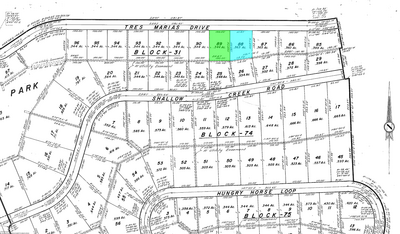

1 09 Acres Tonopah Az Property Id 3379920 Land And Farm

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

City Limits Maricopa County Az

New Supervisor Districts Ok D Maricopa Whole Coolidge Split News Pinalcentral Com

Land Brokers Phoenix Arizona Land For Sale

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Island What Is It Arizona Homes Horse Property

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Nice Chandler Metro Map Zip Code Map Metro Map Map

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Displaced In America Housing Loss In Maricopa County Arizona

2017 Maricopa County Parcel Data Asu Library

Amazon Com Maricopa County Arizona 48 X 36 Paper Wall Map Home Kitchen